Efficient insurance agency management is crucial for lenders to effectively manage their insurance policies, track coverage, and ensure compliance with regulatory requirements. Our Insurance Agency Management System provides a robust set of features and functionalities to simplify and automate your insurance agency operations.

Our Insurance Agency Management System enables lenders to seamlessly manage insurance policies from start to finish. From policy issuance and documentation management to policy renewal tracking and claims processing, our software automates workflows, reduces manual effort, and accelerates policy processing times.

Our CRM features provide a comprehensive view of your insurance customers. You can track customer interactions, store customer information, and manage policy-related communications all in one place. This improves customer service and fosters strong customer relationships.

Our system lets you easily track insurance coverage for your lending portfolios. You can monitor policy expiration dates, ensure continuous coverage, and generate alerts for policy renewals. This helps you mitigate risk and ensure compliance with insurance requirements.

Our software solution includes claims management features that streamline the claims process. You can efficiently track and manage insurance claims, collaborate with providers, and ensure timely resolution. This enhances customer satisfaction and improves claims handling efficiency.

Staying compliant with insurance regulations is crucial for lenders. Our Insurance Agency Management System incorporates compliance features, ensuring adherence to insurance laws, regulations, and reporting requirements. This mitigates compliance risks and helps maintain a strong compliance posture.

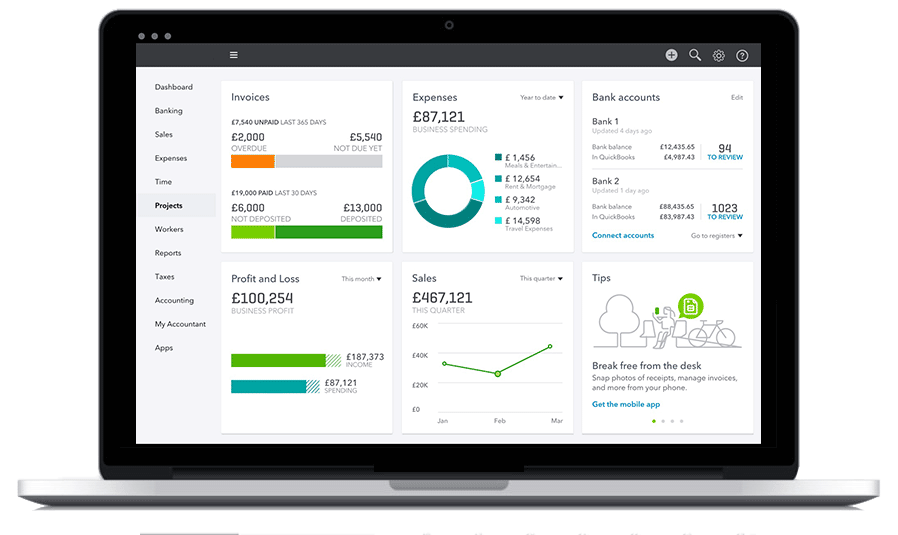

Our system provides robust reporting and analytics capabilities, giving lenders insights into policy performance, claims analysis, and key metrics. Customizable reports and dashboards enable lenders to make data-driven decisions, identify trends, and optimize insurance strategies.

At Misha Infotech, we understand the unique challenges lending institutions face when managing collections efficiently and effectively. Our Collections Management Systems provide comprehensive solutions for the lending industry, empowering organizations to streamline their collections processes, improve recovery rates, and enhance overall operational efficiency.

Efficient loan management is crucial for lenders to effectively manage their loan portfolios, track repayments, and ensure compliance with regulatory requirements. Our Loan Management System provides robust features and functionalities to simplify and automate your loan management operations.

Our LMS enables lenders to seamlessly manage the loan origination process from start to finish. From capturing loan applications and gathering applicant information to credit evaluation and underwriting, our software automates workflows, reduces manual effort, and accelerates loan processing times.

Our LMS provides comprehensive loan servicing capabilities, allowing lenders to manage their loan portfolios effectively. From loan disbursement and repayment tracking to payment processing and collections, our software streamlines loan servicing operations reduces delinquency rates, and improves cash flow.

Our LMS offers secure and efficient payment processing features, allowing borrowers to make payments through various channels. With automated payment processing, borrowers can set up recurring payments, reducing the risk of missed or late payments and improving overall borrower satisfaction.

Our software solution includes collections management features that help lenders effectively manage delinquent loans. With automated collections workflows, borrower communication tools, and integrated reporting, our LMS simplifies collections efforts and improves the chances of successful debt recovery.

Staying compliant with regulatory requirements is crucial for lenders. Our LMS incorporates compliance features, including anti-money laundering (AML), Know Your Customer (KYC), and consumer protection regulations. This ensures that your lending institution adheres to regulatory guidelines, mitigates compliance risks, and maintains a strong compliance posture.

Our LMS provides powerful reporting and analytics capabilities, giving lenders insights into loan performance, portfolio analysis, and key metrics. Customizable reports and dashboards enable lenders to make data-driven decisions, identify trends, and optimize lending strategies.

A global leader in next-generation digital service

Years in the industry

Successful Projects

industries Served

Repeat Customer Rate

Lending software is a digital solution that enables financial institutions and lending organizations to manage their lending operations efficiently, including loan origination, underwriting, servicing, and collections.

Misha Infotech's lending software solutions provide automation, streamlined processes, improved data management, and enhanced customer experiences, resulting in increased operational efficiency and reduced costs.

Misha Infotech offers a range of lending solutions, including loan origination systems, loan management systems, credit scoring and decision tools, loan servicing platforms, collections management systems, and more.

Yes, Misha Infotech ensures that its lending software solutions comply with relevant industry regulations, such as data protection laws, anti-money laundering (AML) regulations, and Know Your Customer (KYC) requirements.

Yes, Misha Infotech's lending software solutions are highly customizable to meet your organisation's specific needs and requirements. We understand that each lending institution has unique workflows and processes

Yes, Misha Infotech's lending software solutions are designed to seamlessly integrate with other systems, such as core banking systems, CRM platforms, credit bureaus, and third-party APIs, ensuring data consistency and efficient information flow.

Misha Infotech's lending software incorporates advanced credit scoring models and risk assessment algorithms to evaluate borrower creditworthiness, enabling lenders to make informed decisions and minimize the risk of defaults.

Yes, Misha Infotech's lending software solutions support multiple loan products, including personal loans, mortgages, auto loans, business loans, and more. The software can be configured to accommodate various loan types and structures